When it comes to protecting your vehicle and ensuring peace of mind on the road, finding the appropriate Auto Insurance can make all the difference. Residents of New Jersey, with some of the most densely populated roads in the United States, understand the importance of being fully covered by a reliable insurance policy.

What You Need to Know About Car Insurance in NJ

New Jersey drivers are required by law to carry a minimum level of Car Insurance. While meeting this legal requirement is mandatory, it is equally crucial to explore options that offer maximum benefits at an affordable rate. This guide breaks down everything you need to know about shopping for Car Insurance in New Jersey, helping you make an informed decision.

Exploring the Options for Cheap Auto Insurance

Searching for Cheap Auto Insurance doesn’t mean compromising on coverage. It’s about finding a policy that offers adequate protection for your vehicle without breaking the bank. Consumers can start by comparing different insurance providers, assessing their premiums, and understanding any additional benefits offered.

While hunting for the most cost-effective deals, always check the reputation of the insurance company, their customer service, and policy flexibility. Some providers allow customization based on your personal driving habits, which could further reduce costs without sacrificing the essential coverage.

How to Get Car Insurance NJ with Ease

The process of securing a solid insurance plan isn’t as daunting as it seems. To Get Car Insurance NJ effortlessly, follow these steps:

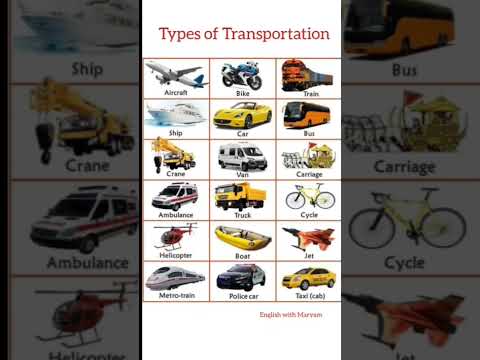

- Assess your insurance needs based on your vehicle use and location.

- Gather multiple quotes from various insurance providers.

- Compare coverage details, deductibles, and total costs.

- Ensure understanding of terms and conditions before committing.

- Opt for additional coverage options if your regular driving scale demands it.

Identifying the Best Auto Insurance for Your Needs

Finding the Best Auto Insurance requires a blend of thorough research and personal judgment. Factors such as your driving record, the type of car you own, and the number of drivers covered under your policy will influence your decision. Prioritize insurers that offer comprehensive plans with added benefits like roadside assistance and accident forgiveness to enhance your coverage.

Ultimately, Auto Insurance in New Jersey should offer robust protection while remaining financially viable. By keeping an eye out for deals, understanding state regulations, and evaluating your specific needs, you can confidently choose a policy that ensures safety and saves money in the long run.