Companies will not be able to claim that overseas costs fall within the exemptions where the main reason that the work is being carried out overseas is due to cost constraints or that the business does not have suitable workers in the UK. HMRC has broadened the scope of who can apply for Advanced Assurance of their R&D claims. All SMEs are eligible to apply for Advance Assurance for R&D they are planning to do (or have already done) as long as the company is not part of a group and none of the companies linked to the claimant entity have previously made a claim.

Currently, it is difficult to ascertain HMRC timescales for processing corporation tax refunds. Therefore, in most instances, following a six weeks or so waiting period, further phone calls to HMRC may be necessary to escalate the refund process. Yes, you can file without penalty until 28 February this year, but leaving it until the last minute is fraught with problems.

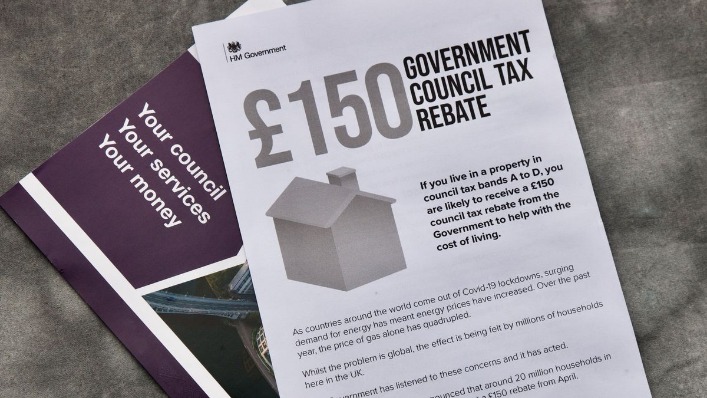

Read more about Tax rebate uk here. Tax ramifications and reporting requirements may be different than the foreign country. For important context, I am employed at a company where the employer handles all taxing themselves, so I have never needed to self-report tax etc. Personal Finance & Money Stack Exchange is a question and answer site for people who want to be financially literate.

National Insurance contributions

If the total passes £85K, then you should register for VAT (if you haven’t already) and begin to follow MTD guidelines. MTD will affect how you run your business, from bookkeeping to filing tax returns. This introductory installment of MTD is huge news for businesses, because it impacts not just how you operate during tax season, but how you run your business on the day to day. If a tax treaty allows you to modify, reduce, or eliminate your tax liability, you’ll need to complete Form 8833 to properly disclose such information on your U.S. tax return. In that case, you must pay taxes on that income in the same manner and at the same rate as one normally would per the instructions on their U.S. tax return. Each Additional Information form must be signed by a named senior officer of the claimant company and must contain detailed information on the R&D project – including the name of the agent who has advised the company on compiling the claim. However, the from does not, in many instances, completely replace the R&D report that is currently submitted by good R&D advisors.

Energy efficiency credits: the case for business

While this study has made practical contributions to China’s policy landscape, it is important to acknowledge certain limitations. Firstly, due to data constraints, our study predominantly focuses on China’s listed firms, potentially overlooking the impact on small and medium-sized enterprises. Future research endeavors could employ firm surveys and case studies to validate and strengthen the robustness of our findings. Secondly, despite our efforts to control for relevant variables at the firm level, it is possible that some factors influencing innovation have not been fully accounted for. Thus, future studies should consider incorporating additional control variables that may play significant roles in the innovation process. Lastly, our examination of the effect of tax reductions on firm innovation has been conducted using a fixed effects model.

The removal of the personal exemption means that overall taxable income has increased for all nonresidents. By creating a Sprintax account you can easily prepare fully completed and compliant 1040NR or 1040NR-EZ (nonresident alien tax return) and form 8843 tax documents. Easily prepare your tax return with Sprintax – the online tax filing software for nonresident aliens. Nonresident aliens who are married cannot choose to file married filing jointly under any circumstances. They should always file separate returns even if they have the right to claim dependents. If your country does not have a tax treaty with the US or the treaty doesn’t cover the type of income you earn, then you must pay tax on this income. As a nonresident, you will be exempt from certain taxes, such as Social Security and Medicare (FICA tax).

There are also several exceptions and rules to know; for example, it doesn’t apply to services like hotel bills. You should also be aware that some merchants and refund companies in Northern Ireland charge a fee for using tax-free shopping. Still, if you’re planning a visit, you could save some money on your shopping.

All this talk of forms, looking for signs, standing in line and getting stamped can take the impulse out of your impulse buy. While many VAT countries have purchase minimums for refunds, in others, any purchase a visitor makes qualifies, no matter how small.

Specifically, it explores the economic dimensions of enhancing financing, specialized division, and creating added value facilitated by tax cuts, shedding light on China’s distinctive path of tax reduction incentives within the national system. Lastly, by employing existing tax rate and tax base methods, this paper empirically tests the incentive effect of individual policies as well as policy combinations on the innovation activities of various manufacturing enterprises. The findings serve as a reference for optimizing tax reduction strategies that guide the innovation trajectory of enterprises. By providing a multifaceted analysis, this paper offers a more comprehensive perspective for understanding the impact of tax cuts on innovation. Moreover, it establishes an essential foundation for enhancing tax reduction policies and achieving high-level technological self-reliance. In practice, as we show in this paper, effective tax rates—based on taxes actually paid—are more often significantly lower than the headline rate.

(1) The positive impact of tax reduction on innovation outweighs the crowding-out effect, indicating an overall stimulating effect. (2) The incentive effect of tax reduction is manifested through the mitigation of financing constraints, the specialized division effect, and the added value creation effect. However, the “financing effect” of tax cuts exhibits channel heterogeneity. Tax cuts can effectively promote corporate R&D investment and innovation output by facilitating internal financing and equity financing, while debt financing channels display a persistent soft constraint. Moreover, the establishment of the “financing effect” is path-dependent for high-tech enterprises. (3) The policy of “additional tax deduction on R&D expenses” demonstrates the most pronounced incentive effect, while the impact of the “15% preferential tax rate” is not significant.