Knowing this can slim down the variety of investment options available and simplify the investing process. On a high degree, investing is the method of determining where you need to go in your financial journey and matching those goals to the proper investments that will assist you get there. This consists of understanding your relationship with risk and managing it over time. Figuring out tips on how to make investments cash begins with figuring out your investing objectives, if you want or wish to achieve them and your consolation stage with risk for each objective. Investing money within the inventory market is amongst the major methods to construct wealth and save for long-term objectives similar to retirement. But figuring out the most effective technique to take a position that money can feel daunting.

For example, a blue chip that trades on the New York Stock Exchange may have a very totally different risk-return profile from a micro-cap that trades on a small exchange. If that also seems like a lot, you do not have to do it all alone. You might have the ability to work with a financial skilled by way of your retirement plan at work, or with a agency like Fidelity. There are loads of options to select from should you really feel like you could use some guidance.

The information on this website is for instructional functions only. It just isn’t intended to be an various to specific individualized tax, authorized, or investment planning advice. Where specific advice is important or applicable, please consult with a professional tax advisor, CPA, monetary planner or investment manager. As well as advising you on your investment decisions an adviser will be capable of open and maintain your platform account on your behalf.

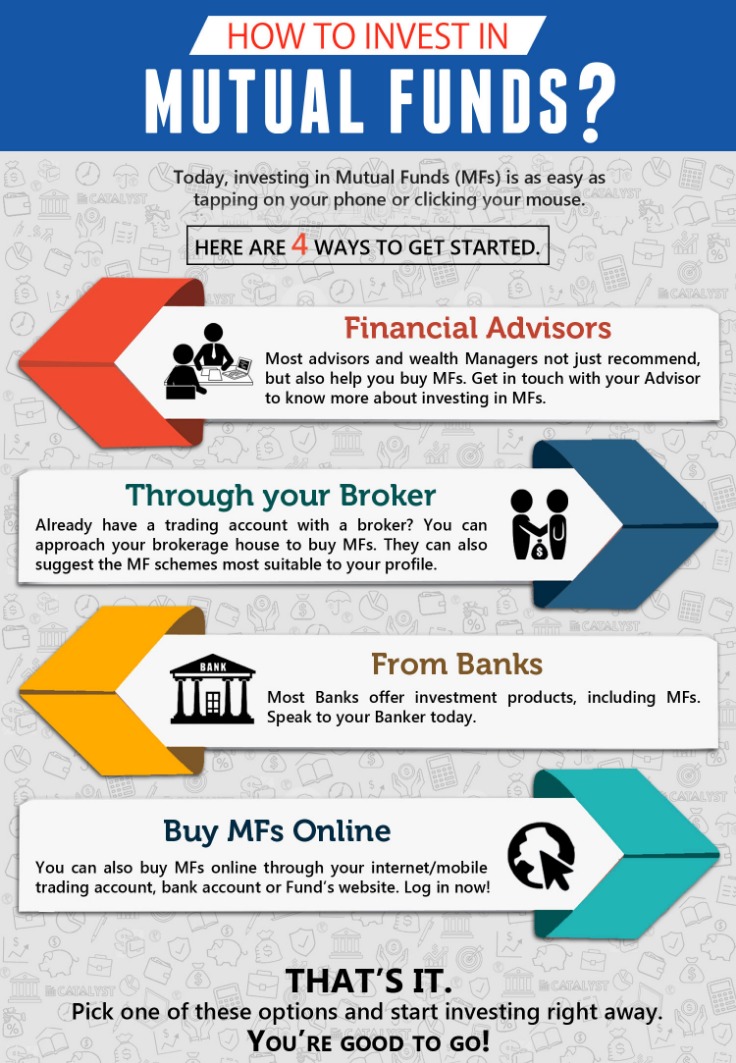

Each investment fund features a various array of corporations; if one firm does poorly in a yr, one other would possibly do properly, which offers balance in loss and progress. Funds may additionally allocate their assets (i.e., your money) in diverse ways, putting a certain proportion in shares, one other in bonds, and the remaining in money. Both are an example of diversification, which might help to unfold out the danger. The best method to make investments for long-term, consistent development is to place your money into good progress stock mutual funds. A mutual fund is an investment that pools money from a bunch of individuals to buy shares in different firms. Bonds have a status for being “lower-risk” investments because they don’t fluctuate as wildly as stocks.

The good news is that today’s kids have better access to financial info, easy-to-use funding platforms and low-cost index funds than any era earlier than them. The dangerous news is that too many are falling sufferer to traps that will crimp their already meagre anticipated returns. Even so, the long-term outlook for stocks, which have historically been the primary source of investors’ returns, remains dim.

Retirement

Read more about visit how2invest here.

This is how much of your income should go toward investing, according to experts

There are lots of of different varieties of these funds, and the alternatives can be overwhelming. That’s why most people with investment accounts choose investments primarily based on age or danger tolerance. For both, it’s necessary to know the role of threat and diversification in your funding choices.

Virtually all of the main brokerage firms and lots of impartial advisors provide these services. When you put money into a stock, you’re hoping the corporate grows and performs nicely over time. Bankrate.com is an impartial, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored services and products, or by you clicking on sure links posted on our web site.

Index funds track a selected index and could be a good approach to invest. Now you understand the investing basics, and you’ve got got some cash you want to invest. Morgan Self-Directed Investing account with qualifying new cash.

Diversification and asset allocation do not ensure a revenue or guarantee against loss. This info is intended to be educational and is not tailor-made to the funding needs of any specific investor. The S&P 500 (also often recognized as the Standard & Poor’s 500) is a inventory index that consists of the 500 largest companies in the U.S. Its efficiency is usually thought-about the most effective indicator of how U.S. shares are performing total.