When it comes to choosing where to park your hard-earned money, finding the best savings rates can make a significant impact on your financial future. Whether you are saving for a rainy day, a big purchase, or retirement, opting for a bank or financial institution that offers competitive interest rates is crucial. Here’s everything you need to know to get started:

What are Savings Rates?

Savings rates, also known as interest rates, refer to the percentage of interest that a financial institution pays you on your savings deposits. These rates can vary from one bank to another and can change frequently based on market conditions.

How to Find the Best Savings Rates

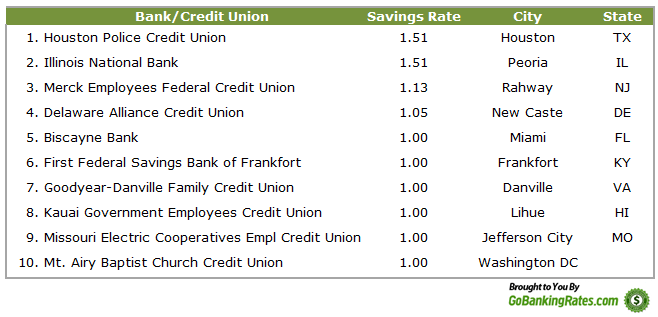

- Research different banks and credit unions to compare their savings rates.

- Look for online banks, as they often offer higher interest rates due to lower overhead costs.

- Consider opening a high-yield savings account for even better rates.

- Check for promotional offers or introductory rates that can boost your savings in the short term.

- Keep an eye on interest rate trends and be willing to switch accounts if you find a better deal elsewhere.

Read more about heloc loans here.

FAQs about Savings Rates

Q: Are savings rates the same as annual percentage yield (APY)?

A: While savings rates refer to the interest rate itself, APY takes into account compounding interest, giving you a more accurate picture of how much you will earn on your savings over time.

Q: Can savings rates go down?

A: Yes, savings rates are not fixed and can fluctuate based on changes in the economy and the Federal Reserve’s monetary policies.

By taking the time to research and compare different savings rates, you can make the most of your savings and watch your money grow over time. Remember, every percentage point counts when it comes to building your wealth, so choose wisely and watch your savings flourish!